Essential Business Strategies: Bear Hug Tactics, Building a Book of Business, and Harvard Business School Insights

Introduction

In today’s dynamic business environment, understanding specialized strategies and concepts is crucial for professionals aiming to drive growth, manage risk, and build lasting value. This comprehensive guide explores three advanced business topics: the bear hug acquisition strategy , the fundamentals of a book of business , and the core teachings at Harvard Business School . By mastering these areas, business leaders and sales professionals can position themselves for success in competitive markets.

Bear Hug in Business: Strategy, Implementation, and Implications

What Is a Bear Hug in Business?

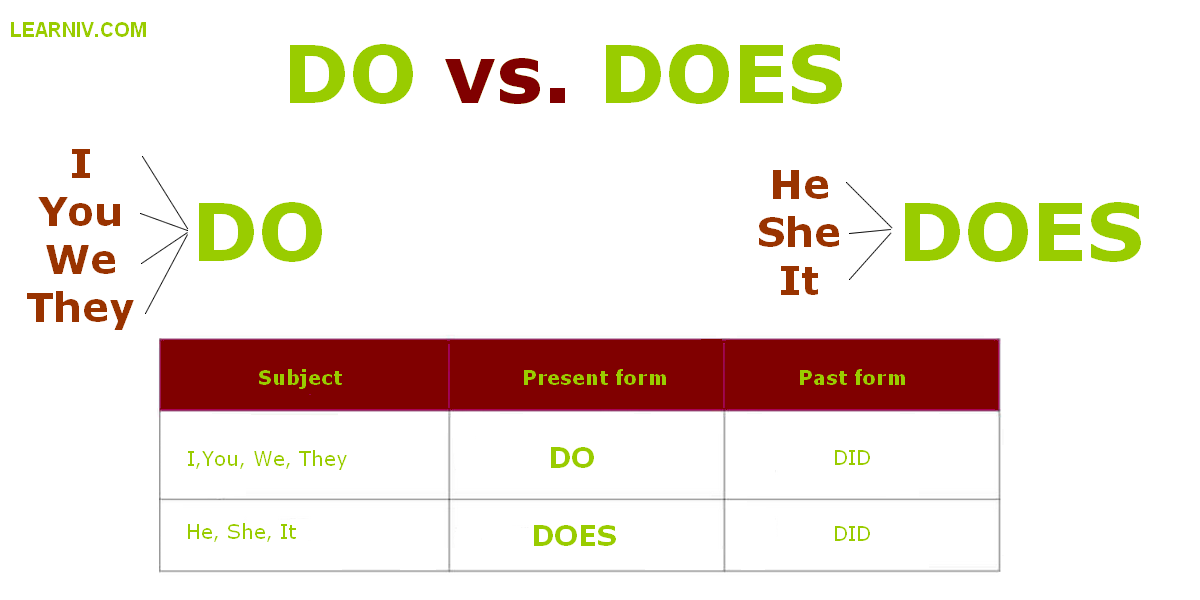

A

bear hug

in business refers to an aggressive acquisition tactic where a company offers to buy another company at a price significantly higher than its current market value. This approach is often

unsolicited

, meaning the target company is not actively seeking a buyer. The acquiring firm presents a generous offer directly to the target’s board of directors, leveraging fiduciary duty-directors must consider offers that provide substantial value for shareholders.

[1]

[5]

How Does the Bear Hug Work?

The process typically involves the acquirer sending a formal bear hug letter to the target’s board, detailing the premium purchase offer and terms. The aim is to make the offer so attractive that the board feels obliged to accept or seriously consider it, even if management is resistant. By offering a price well above market value, the bear hug minimizes the risk of competing bids and accelerates negotiations. [3]

Real-World Example

A notable example is Microsoft’s bid to acquire Yahoo!, where Microsoft proposed an acquisition premium of 62% above Yahoo’s pre-merger value, creating pressure for Yahoo’s board to accept. [4]

Benefits and Challenges

Benefits: The bear hug approach can lead to rapid acquisitions, discourage rival bids, and provide substantial shareholder value. Challenges: This strategy is expensive for the acquirer and can create tension or resistance from target management, especially if the offer is perceived as hostile. [2]

Implementation Guidance

To execute a bear hug strategy:

- Conduct thorough due diligence to justify the premium offer.

- Draft a detailed bear hug letter outlining terms and rationale.

- Engage legal and financial advisors to manage risks and regulatory compliance.

- Prepare for potential negotiation challenges or public scrutiny.

Alternative Approaches: Consider friendly negotiations or joint ventures if a bear hug may jeopardize long-term relationships or reputation.

Building and Managing a Book of Business

Definition and Importance

A book of business refers to the collection of clients, accounts, or revenue streams that a professional-often in sales, finance, or consulting-actively manages. This portfolio is a critical asset that reflects a professional’s capacity to generate ongoing value for their employer or themselves.

Source: en.wikipedia.org

Key Components

Your book of business typically includes:

- Client Relationships: Existing and potential clients you serve.

- Revenue Streams: Sales, contracts, or recurring business associated with those clients.

- Account History: Records of transactions, service issues, and growth opportunities.

Practical Steps to Build a Book of Business

To grow a robust book of business:

- Identify and Target Prospects: Use market research and referral networks to find high-value leads.

- Develop Relationships: Build trust through consistent communication and personalized service.

- Track Performance: Use CRM systems to monitor client engagement and sales activity.

- Deliver Value: Offer solutions that address client needs, leading to higher retention and referrals.

- Expand Portfolio: Seek cross-sell and upsell opportunities within existing accounts.

Challenges and Solutions

Challenges: Competition, client churn, and market shifts can erode your book of business. Solutions: Invest in ongoing education, adapt to new technologies, and maintain proactive client outreach to stay ahead.

Alternative Strategies

If traditional relationship-building is slow, consider digital outreach, partnerships, or leveraging content marketing to attract new clients more efficiently.

What They Teach You at Harvard Business School

Overview of Harvard Business School’s Approach

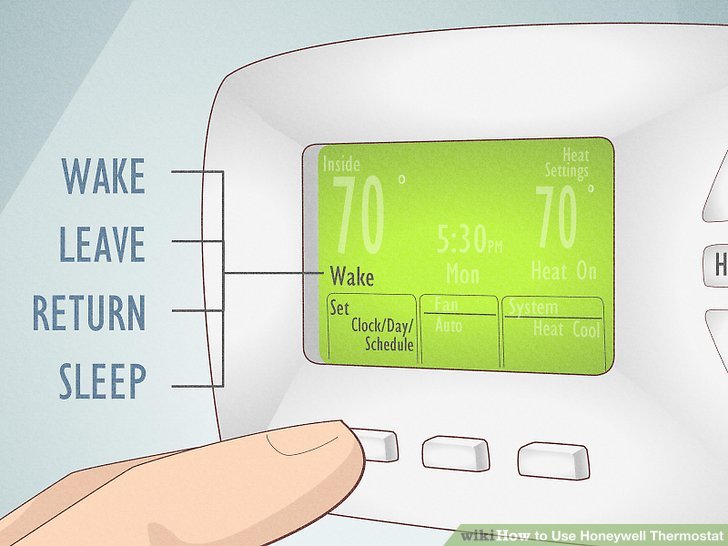

Harvard Business School (HBS) is renowned for its case method pedagogy, rigorous curriculum, and deep focus on leadership, strategy, and innovation. While specific course content evolves, the core teachings can be summarized as follows:

Core Concepts and Curriculum

HBS emphasizes:

- Strategic Thinking: Analyzing complex business problems and formulating actionable strategies.

- Leadership Development: Cultivating the mindset and skills to lead teams and organizations in uncertain environments.

- Financial Acumen: Understanding corporate finance, accounting, and valuation techniques essential for decision-making.

- Marketing and Operations: Designing effective go-to-market strategies and optimizing business processes.

- Ethics and Social Responsibility: Evaluating the impact of decisions on stakeholders and society.

Case Study Method

Students learn through real-world case studies, fostering critical thinking, debate, and collaborative problem-solving. This method prepares graduates to tackle ambiguous, high-stakes business challenges.

Source: thoughtco.com

Actionable Guidance for Prospective Students

If you are interested in attending HBS:

- Review admissions requirements and prepare for GMAT or GRE testing.

- Demonstrate leadership experience and analytical skills in your application.

- Highlight impact-driven achievements and a commitment to learning.

For accurate and up-to-date admissions information, visit the official Harvard Business School website at hbs.edu . This site provides details on application deadlines, program offerings, and financial aid.

Alternative Pathways

If a full-time MBA is not feasible, consider Harvard’s executive education programs, online courses, or case study resources for professional development. These offerings can be accessed through the Harvard Business School’s official site.

Key Takeaways

Mastering advanced acquisition strategies like the bear hug, building a resilient book of business, and applying Harvard Business School’s foundational lessons are essential for business leaders seeking lasting growth and influence. By leveraging these concepts, professionals can navigate complex negotiations, maximize client value, and lead with confidence in a rapidly changing marketplace.

References

- [1] Indeed (2025). What Is a Bear Hug in Business? (Definition and Example).

- [2] CapLinked (2024). Understanding Bear Hug Acquisitions & Hostile Takeovers.

- [3] Corporate Finance Institute (2025). Bear Hug – Definition, How It Works, Reasons for a Takeover.

- [4] Beyond 8 Figures (2024). What Is A Bear Hug In Business?

- [5] Dealroom (2025). What is a Bear Hug in Finance? Hostile Takeover Type.

- Harvard Business School (2025). Official Harvard Business School Website.

MORE FROM mumsearch.com