Understanding Small Business Loans, Start-Up Costs, and Opportunity Viability

Introduction

Launching and growing a business requires critical decisions about financing, opportunity evaluation, and start-up costs. Entrepreneurs must choose the right type of loan, understand the financial commitment for different business models, and assess the viability and funding potential of each opportunity. This guide addresses key questions regarding small business loans, start-up costs, opportunity characteristics, and funding viability, providing actionable steps and verified information to help you navigate the path to successful business ownership.

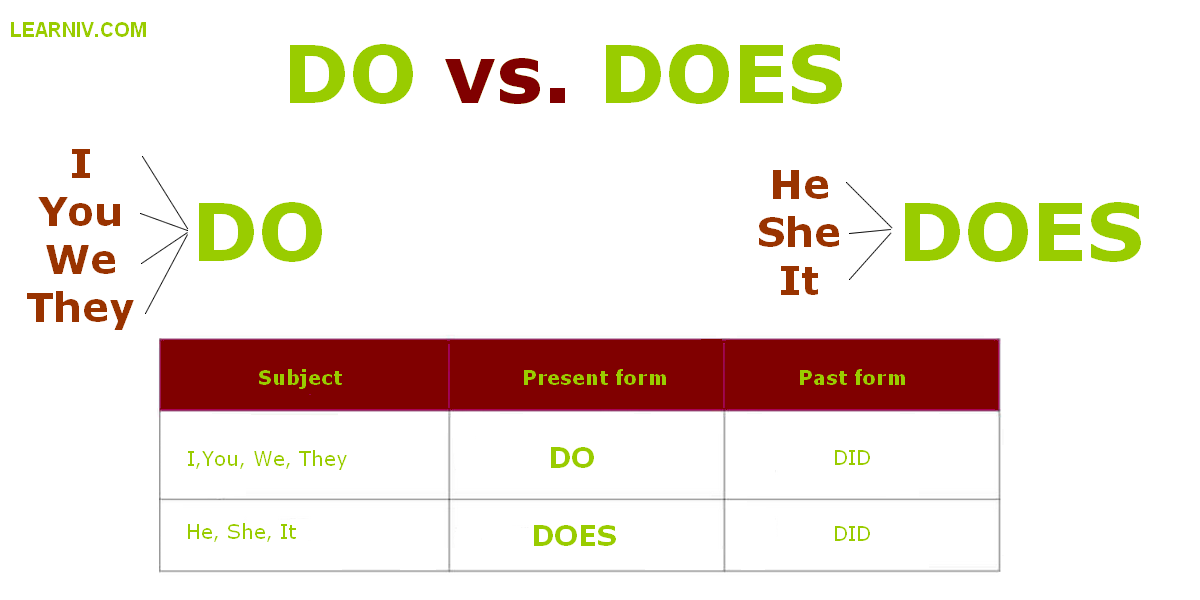

Are Small Business Loans Installment or Revolving?

Small business loans are available in two primary forms: installment loans and revolving credit . The choice between these options depends on your business’s financial needs and repayment preferences.

Installment Loans

An installment loan provides a lump sum of funding that is repaid over a fixed period with regular payments. Typical examples include SBA loans, term loans, and equipment financing. These loans are ideal for large, planned investments such as purchasing real estate, upgrading equipment, or launching a major project. The predictable repayment schedule and fixed interest rates make budgeting easier, but installment loans usually require collateral and lack flexibility once funds are disbursed. For more information on installment loans, you can visit trusted financial education sites or consult with a local bank’s small business lending department. [1] [2] [3]

Revolving Credit

Revolving credit, such as a business line of credit or business credit card, offers ongoing access to funds up to a preset limit. You can borrow, repay, and borrow again as needed, paying interest only on the amount used. This structure is suitable for managing cash flow fluctuations, covering unexpected expenses, or handling day-to-day operational costs. Revolving credit may come with higher interest rates and requires discipline to avoid excessive debt. Seek guidance from your financial advisor or inquire with established lenders about revolving credit options. [1] [2] [4]

Choosing Between Installment and Revolving Loans

When deciding which loan type suits your needs, assess your funding requirements, repayment capacity, and the purpose of the loan. For one-time, significant expenses, installment loans offer structure and stability. For ongoing, unpredictable costs, revolving credit provides flexibility. Comparing offers from multiple lenders and consulting with a financial advisor can help you secure a loan that aligns with your business goals. [5]

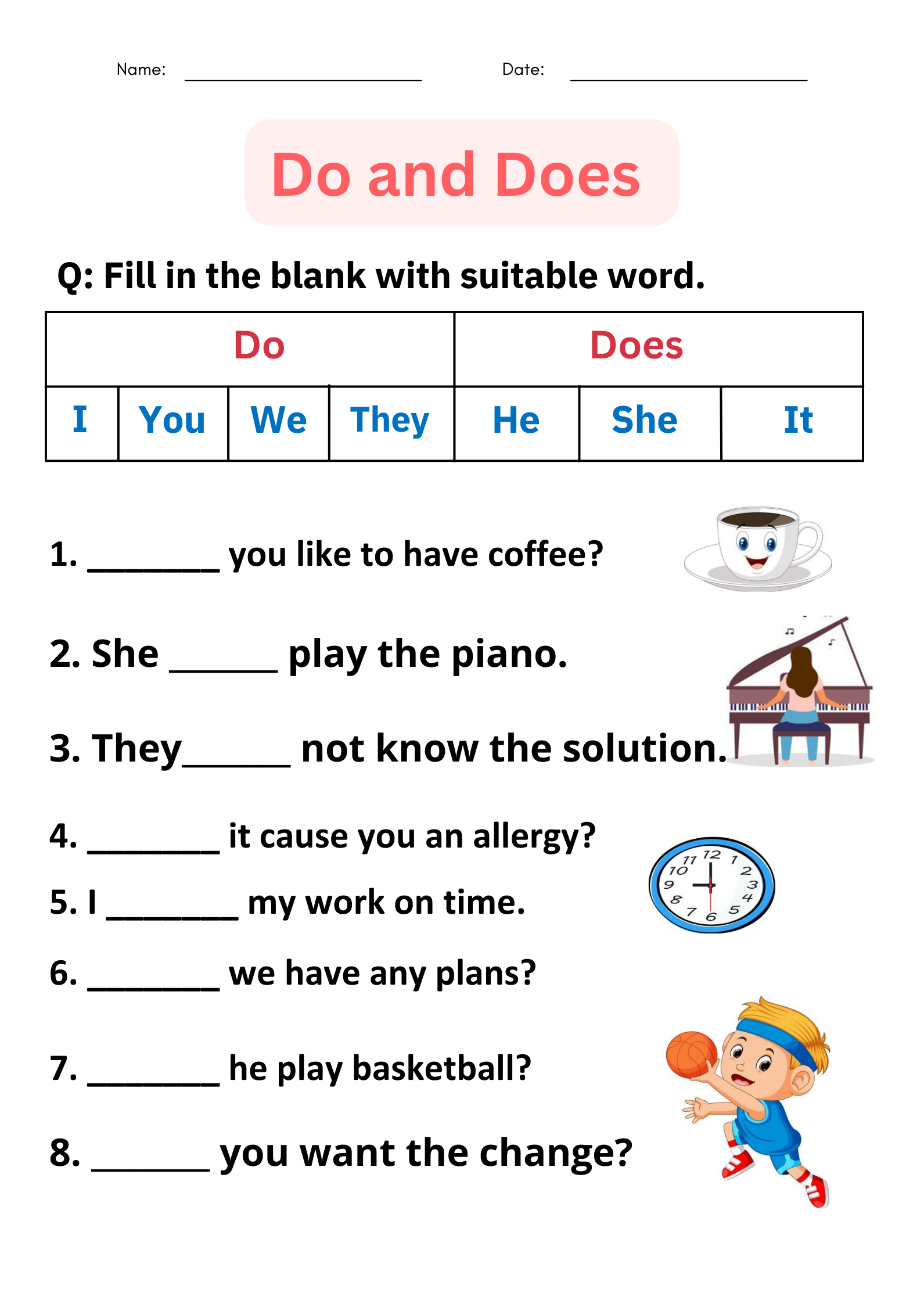

Which Business Opportunity Involves Higher Start-Up Costs?

Start-up costs vary widely depending on the type of business opportunity. Generally, brick-and-mortar businesses such as restaurants, retail stores, or manufacturing facilities require higher initial investments compared to service-based or online businesses.

Examples of High Start-Up Cost Opportunities

Restaurants typically incur substantial costs for leasehold improvements, kitchen equipment, inventory, staffing, and regulatory compliance. Retail stores face expenses for inventory, fixtures, rent, and marketing. Manufacturing businesses need significant capital for machinery, raw materials, facility setup, and workforce training. These ventures often require hundreds of thousands of dollars upfront and may need additional working capital to cover operational expenses until profitability is achieved.

Lower Start-Up Cost Opportunities

On the other hand, online businesses , consulting, or home-based service ventures typically involve lower overhead costs. These models may only require investment in a website, marketing, and essential tools or certifications. However, lower start-up costs do not necessarily guarantee success or lower risk, so careful planning remains essential.

Source: alamy.com

How to Estimate Start-Up Costs

To accurately estimate start-up costs for your chosen opportunity, list all necessary expenses such as equipment, inventory, licenses, insurance, and initial marketing. Factor in a buffer for unforeseen costs. For brick-and-mortar businesses, consider obtaining quotes from contractors, suppliers, and service providers. For online or service businesses, research software, advertising, and professional fees. Local Small Business Development Centers (SBDCs) and SCORE chapters can provide free guidance and templates for estimating costs.

Characteristics of a Business Opportunity

Evaluating a business opportunity requires understanding its core characteristics. A viable opportunity should meet several criteria:

- Market Demand : There must be sufficient customer interest in the product or service.

- Profit Potential : The opportunity should offer the potential for sustainable profits after covering all costs.

- Feasibility : The business must be realistically achievable with available resources and skills.

- Competitive Advantage : The opportunity should allow you to differentiate from competitors, whether through innovation, pricing, or service.

- Scalability : Ideally, the business can grow beyond its initial scope, increasing revenue and market share.

Other essential characteristics include legal compliance, alignment with personal goals and expertise, and adaptability to market changes. Researching industry trends, conducting market analysis, and speaking with mentors can help validate the opportunity’s potential.

Viability Factor: Potential Funding of a Business Opportunity

When assessing the viability of a business opportunity, potential funding is a critical factor. Entrepreneurs must ensure that adequate capital is available to launch, sustain, and scale the business.

Evaluating Funding Sources

Common funding sources include personal savings, loans (installment or revolving), investor capital, grants, and crowdfunding. The availability and terms of these sources directly impact the business’s ability to survive early challenges and pursue growth. To assess funding viability:

- Determine the total capital required for start-up and initial operations.

- Identify potential lenders, investors, or grant programs. Use official channels such as local banks, the Small Business Administration (SBA), and recognized crowdfunding platforms.

- Prepare a comprehensive business plan and financial projections to demonstrate your funding needs and repayment capacity.

- Explore alternative financing strategies, such as bootstrapping, strategic partnerships, or phased rollouts, if traditional funding is limited.

Securing funding often requires diligence, persistence, and adaptability. If you are unable to obtain traditional loans, consider government programs, microloans, or seeking advice from experienced entrepreneurs and mentors. For official information, visit the Small Business Administration’s website or speak with a local SBDC advisor.

Source: alamy.com

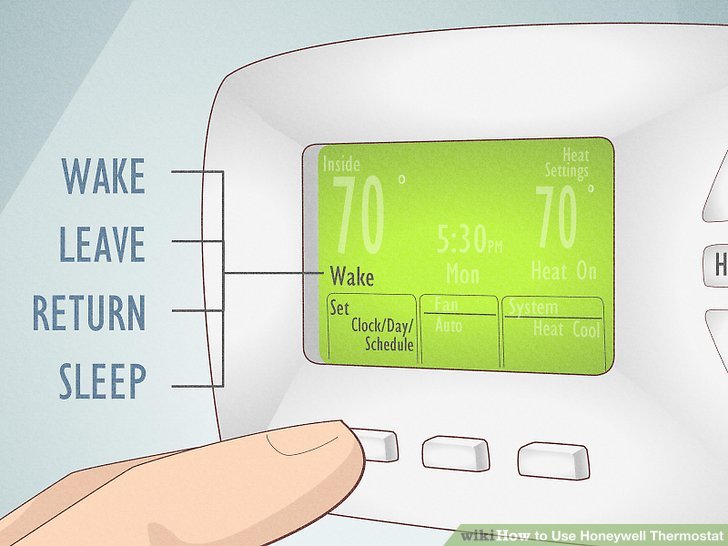

Practical Steps for Entrepreneurs

To access small business loans and evaluate opportunities:

- Assess your business’s financial needs and determine whether an installment loan or revolving credit is appropriate.

- Research multiple lenders, compare rates, terms, and eligibility requirements, and seek advice from financial professionals.

- Estimate start-up costs thoroughly and prepare for contingencies.

- Evaluate each opportunity using the criteria outlined above, including market demand, profit potential, feasibility, and funding availability.

- Prepare a robust business plan and seek feedback from mentors or advisors to strengthen your proposal for funding.

- Contact your local Small Business Development Center or SCORE chapter for free counseling and resources.

For additional guidance, search for ‘business loan comparison’, ‘start-up cost calculator’, and ‘SBA loan eligibility’ using official banking and government resources. Always verify the legitimacy of programs before sharing personal information or applying for funding.

Key Takeaways

Choosing the right loan type, understanding start-up costs, and evaluating business opportunities are essential for entrepreneurial success. Make informed decisions by consulting verified sources, seeking professional advice, and leveraging official support channels. With careful planning and prudent financial management, you can maximize your chances of building a sustainable, profitable business.

References

- [1] OnDeck (2023). Is a Small Business Loan Installment or Revolving?

- [2] SMB Compass (2024). Is a Small Business Loan an Installment Loan or Revolving Credit?

- [3] SoFi (2025). Installment Loan vs Revolving Credit: Know the Difference.

- [4] Episode Six (2024). Is a small business loan an installment or revolving loan?

- [5] NerdWallet (2024). Is a Small-Business Loan Installment or Revolving?

MORE FROM mumsearch.com