Step-by-Step Guide: Buying a Car Through Your Business for Maximum Benefits

Introduction

Purchasing a car through your business can offer substantial financial and operational benefits, but it requires careful planning and compliance with specific procedures. This guide provides actionable, step-by-step instructions for buying a car through your business, including how to leverage business credit, choose appropriate financing, manage registration, and access tax advantages. Each section is designed to help you make informed decisions and avoid common pitfalls.

Determining Business Needs

Start by assessing why your business needs a vehicle . Consider the core function of your business and how a vehicle can enhance productivity, efficiency, or service delivery. For instance, a construction company may require a truck with towing capacity, while a consultancy might prefer a fuel-efficient sedan for frequent client visits. Reference your business’s mission statement and operational goals to ensure the vehicle aligns with both your values and practical requirements [1] .

Real-world example: A landscaping business may need a van capable of carrying equipment and staff, while a catering company could benefit from a refrigerated vehicle for food transport.

Key takeaway: The right vehicle should directly support your business objectives and daily operations.

Source: fool.com

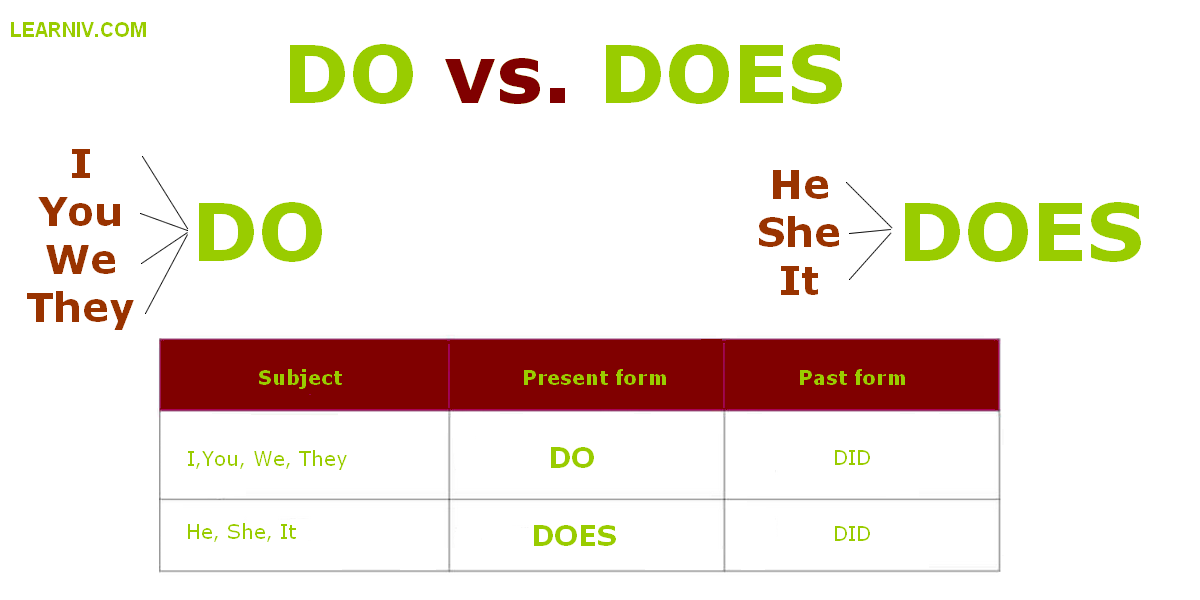

Building and Understanding Business Credit

To purchase a car through your business, you’ll need a business credit profile . Business credit is separate from personal credit and tied to your Employer Identification Number (EIN). Major credit bureaus such as Dun & Bradstreet, Experian, and Equifax offer business credit reports. Begin by creating a profile and consistently paying bills early, maintaining low credit utilization, and ensuring public records are clean [2] .

It can take up to two years to build sufficient business credit. A score above 80 (on a 1-100 scale) is typically required to qualify for a business auto loan. If your business credit isn’t strong enough, lenders may require a personal guarantee or cosigner.

Practical steps:

- Register your business and obtain an EIN.

- Open business bank accounts and lines of credit.

- Pay vendors and creditors promptly.

- Monitor your credit profile and address any discrepancies.

Alternative approach: If you lack sufficient business credit, consider using a personal guarantee or explore leasing options which may have more relaxed requirements [4] .

Choosing the Right Vehicle

Once your business credit is established, select a vehicle that fits your business needs. Consider factors such as fuel efficiency, cargo capacity, reliability, and brand image. Balance these with budget constraints and intended usage-vehicles used exclusively for business may be eligible for more tax deductions. Consult with your team and accountant to ensure the choice supports long-term goals [1] .

Implementation guidance:

- List required features (e.g., seating, storage, towing capacity).

- Compare models and manufacturers for reliability and resale value.

- Test drive shortlisted options to assess comfort and performance.

Potential challenge: Purchasing a vehicle that doesn’t suit your operational needs can result in wasted resources and inefficiency.

Source: fool.com

Financing Options and Insurance

Financing through your business opens access to various products, including chattel mortgages, finance leases, commercial hire purchases, and secured car loans . These differ from consumer car loans and may offer lower interest rates or flexible repayment schedules [3] . Prepare to provide detailed financial information (balance sheet, income statements) to lenders.

Insurance is mandatory before registration. Shop around for business auto insurance policies and compare coverage options, premiums, and deductibles. Insurers may require proof of business use and additional details about drivers and expected mileage [1] .

Alternative pathway: If you do not qualify for a business auto loan, leasing may be more accessible and still offers many corporate benefits [4] .

Purchasing and Registering the Vehicle

After securing financing and insurance, purchase the vehicle under your business’s legal name. The vehicle title must reflect the business name. Work with the commercial sales department at dealerships, as they specialize in business transactions and can guide you through the process [1] .

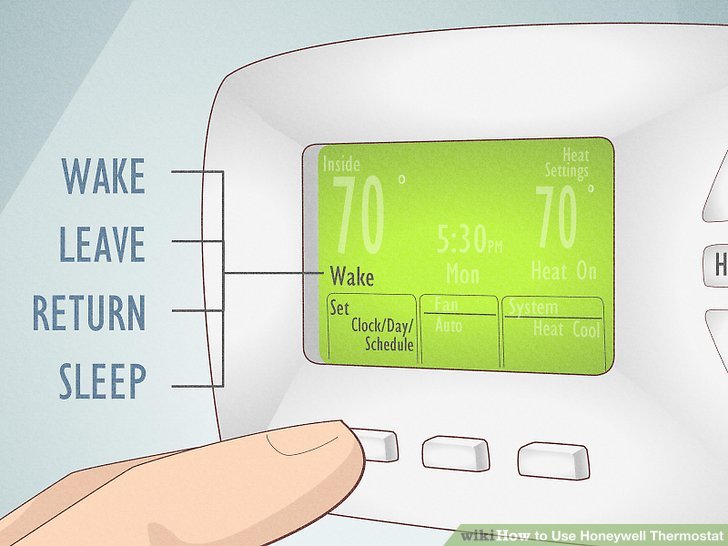

Register the vehicle with your state’s Department of Motor Vehicles (DMV). Requirements typically include proof of insurance, purchase documents, and your EIN. Registration under the business name is essential for accessing tax deductions and liability protection.

Practical guidance: Contact your local DMV or visit their official website for specific registration procedures. Bring all necessary documentation, including business formation papers, insurance policy, and bill of sale.

Tax Advantages and Accounting

One of the biggest benefits of buying a car through your business is the potential for significant tax deductions . You may deduct vehicle expenses such as depreciation, loan interest, insurance premiums, fuel, maintenance, and repairs. The IRS allows businesses to choose between deducting actual expenses or using the standard mileage rate, depending on which method yields greater savings [1] .

Work closely with your accountant to track all vehicle-related expenses and ensure compliance with IRS regulations. If the vehicle is used for both business and personal purposes, only the business-use percentage is deductible. Maintain thorough records, including mileage logs and receipts.

Potential challenge: Misclassifying expenses or failing to document business use can lead to denied deductions or tax penalties.

Alternative Approaches and Challenges

If your business is new or has limited credit, you may need to use your personal credit as a guarantee. This can expose your personal assets to risk, so weigh the pros and cons carefully. Leasing is a viable alternative for businesses seeking flexibility and lower upfront costs. Some leasing programs allow you to upgrade vehicles regularly and avoid depreciation concerns [4] .

Common challenges include:

- Insufficient business credit

- Limited financing options

- Unexpected insurance costs

- Complex registration requirements

Solutions: Build credit proactively, consult with commercial sales experts, shop multiple lenders, and work with experienced accountants or legal advisors.

Step-by-Step Summary

1. Assess business needs and vehicle usage. 2. Build and monitor business credit profile. 3. Select the right vehicle for your operational goals. 4. Compare financing and insurance options. 5. Purchase and register the car in your business’s name at your state DMV. 6. Track expenses and consult with your accountant for tax advantages.

Accessing Services and Further Guidance

To begin the process, you can:

- Contact business credit bureaus like Dun & Bradstreet, Experian, or Equifax to review or establish your business credit profile.

- Speak with the commercial sales department at local dealerships for tailored financing and purchasing options.

- Shop for business auto insurance with established providers and request quotes based on business use.

- Visit your state DMV’s official website or office for vehicle registration procedures.

- Consult a certified public accountant (CPA) for comprehensive tax planning and deduction strategies.

If you encounter challenges, consider alternative financing, leasing, or engaging a legal or financial advisor for guidance. Many professional organizations and trade associations offer resources and referrals to help business owners navigate the process.

References

- [1] Business.com (2024). 7 Lessons About Buying a Business Car.

- [2] J.D. Power (2024). How to Buy a Car Under a Business Name.

- [3] DynaMoney (2023). Our 5 Step Guide to Buying a Vehicle for Your Small Business.

- [4] YouTube (2022). How to Buy a Car in Your Business Name.

- [5] Chase (2024). A Guide to Buying a Car for Business Use.

MORE FROM mumsearch.com