Business Finance Career Pathways: Complete Guide to Opportunities and Requirements

Understand business finance career pathways

The business finance pathway represent one of the near dynamic and rewarding career clusters in today’s economy. This comprehensive field encompass various roles that focus on manage money, investments, and financial planning for individuals, businesses, and organizations. Understand which careers belong to this pathway help students and professionals make informed decisions about their future.

Business finance careers typically involve analyze financial data, make investment recommendations, manage budgets, and help organizations achieve their financial goals. These positions require strong analytical skills, attention to detail, and the ability to work with complex financial instruments and regulations.

Core careers in the business finance pathway

Financial analyst

Financial analysts evaluate investment opportunities, assess market trends, and provide recommendations to businesses and individuals. They analyze financial statements, economic conditions, and industry developments to guide decision make processes. This role requires proficiency in financial modeling, statistical analysis, and market research techniques.

Investment banker

Investment bankers help companies raise capital through various financial instruments, include stocks, bonds, and other securities. They facilitate mergers and acquisitions, provide strategic financial advice, and manage complex financial transactions. This demand career path oftentimes requires long hours but offer substantial compensation and growth opportunities.

Corporate finance manager

Corporate finance managers oversee a company’s financial operations, include budgeting, forecasting, and capital allocation. They work intimately with executive teams to develop financial strategies that support business objectives and ensure optimal use of company resources.

Financial planner

Financial planners help individuals and families create comprehensive financial strategies for retirement, education funding, and wealth building. They assess clients’ financial situations, risk tolerance, and long term goals to develop personalized investment and savings plans.

Credit analyst

Credit analysts evaluate the creditworthiness of individuals and businesses apply for loans or credit facilities. They analyze financial statements, credit histories, and market conditions to assess risk levels and make lending recommendations.

Careers not typically include in business finance pathways

While many finances relate positions fall within the business finance pathway, certain careers belong to different clusters or pathways. Understand these distinctions help clarify career classification and educational requirements.

Insurance underwriter

Insurance underwriters typically belong to the insurance pathway instead than business finance. They evaluate insurance applications, assess risk factors, and determine coverage terms and premiums. While they work with financial concepts, their primary focus is risk assessment for insurance products.

Real estate appraiser

Real estate appraisers commonly fall under the real estate pathway. They determine property values for buying, selling, or refinance purposes. Although they work with financial valuations, their expertise centers on property assessment preferably than business finance.

Tax preparer

Tax preparers oftentimes belong to the accounting pathway instead than business finance. They help individuals and businesses complete tax returns and ensure compliance with tax regulations. Their work focus on tax law and preparation preferably than investment or financial planning.

Finance career cluster pathways

The finance career cluster encompass several distinct pathways, each with specific focus areas and career opportunities. Understand these pathways help students and professionals identify the about suitable career direction.

Business finance pathway

This pathway focus on corporate finance, investment analysis, and financial planning for businesses. Careers include financial analysts, investment bankers, corporate treasurers, and financial managers. Professionals in this pathway typically work for corporations, investment firms, or financial institutions.

Banking and related services’ pathway

The banking pathway encompass careers in commercial banking, retail banking, and relate financial services. This includes bank managers, loan officers, customer relationship managers, and compliance specialists. These professionals work direct with customers and businesses to provide banking products and services.

Insurance pathway

Insurance professionals work in risk assessment, policy development, and claims management. Careers include insurance agents, underwriters, claims adjusters, and actuaries. This pathway focus on protect individuals and businesses from financial losses through various insurance products.

Source: vistasocial.com

Securities and investments pathway

This pathway center on investment management, securities trading, and portfolio analysis. Careers include stockbrokers, portfolio managers, research analysts, and compliance officers. Professionals in this field help clients invest in stocks, bonds, mutual funds, and other securities.

Educational requirements and qualifications

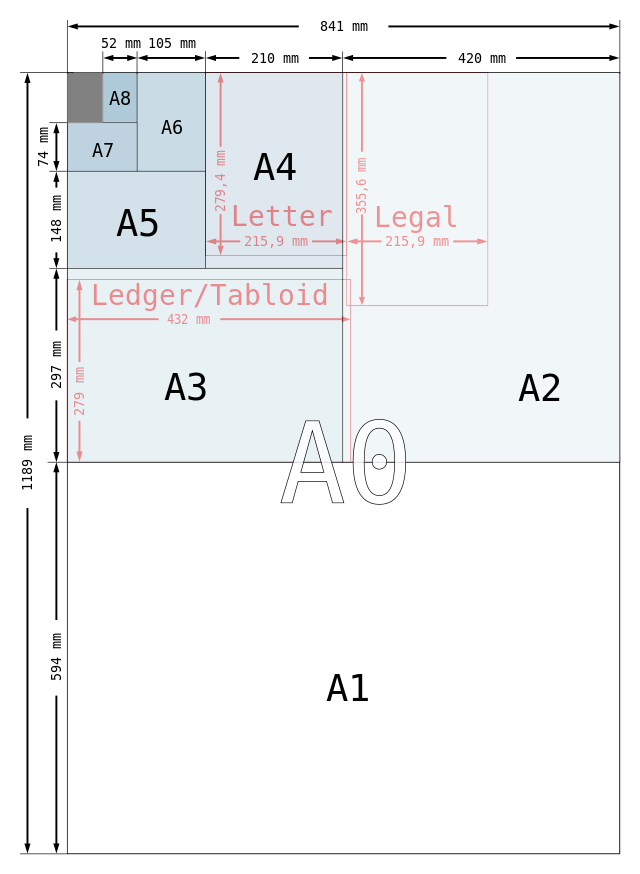

Most business finance careers require at least a bachelor’s degree in finance, economics, accounting, or a related field. Many positions prefer candidates with advanced degrees, such as a master of business administration (mMBA)or specialized finance certifications.

Essential skills

Successful finance professionals possess strong analytical skills, mathematical aptitude, and attention to detail. Communication skills are evenly important, as finance professionals must explain complex concepts to clients and colleagues. Technology proficiency, specially with financial software and databases, is progressively essential.

Source: masteringgrammar.com

Professional certifications

Many finance careers benefit from professional certifications that demonstrate expertise and commitment to the field. Popular certifications include the chartered financial analyst (cCFA) financial risk manager ( (mFRM)nd certified financial planner ( cf()CFP)gnations.

Career advancement opportunities

The business finance pathway offer numerous advancement opportunities for dedicated professionals. Entry level analysts can progress to senior analyst positions, so move into management roles such as finance director or chief financial officer.

Many finance professionals besides transition between different areas within the field. For example, a corporate finance analyst might move into investment banking, or a financial planner might transition to portfolio management. This flexibility allows professionals to explore different aspects of finance throughout their careers.

Industry trends and future outlook

The finance industry continue to evolve with technological advances and change market conditions. Artificial intelligence and machine learning atransformedorm how financial analysis is conduct, create new opportunities for professionals who can adapt to these technologies.

Sustainable finance and environmental, social, and governance (eESG)investing are grgrownreas within the field. Professionals with expertise in these areas are progressively in demand as companies and investors focus on sustainable business practices.

Remote work opportunities

The finance industry has embrace remote and hybrid work arrangements, peculiarly follow recent global events. Many finance positions can be performed remotely, offer professionals greater flexibility in their work arrangements.

Salary expectations and compensation

Business finance careers typically offer competitive compensation packages, with salaries vary base on experience, location, and specific role. Entry level positions oft start with solid base salaries, while senior roles can command substantial compensation include bonuses and equity participation.

Investment banking and securities trading typically offer the highest compensation potential, while financial planning and analysis roles provide more work-life balance with competitive salaries. Corporate finance positions oftentimes include comprehensive benefits packages and long term incentive plans.

Choose the right finance career path

Select the appropriate finance career path require careful consideration of personal interests, skills, and career goals. Students should evaluate whether they prefer work with individual clients, corporate teams, or market analysis when make their decision.

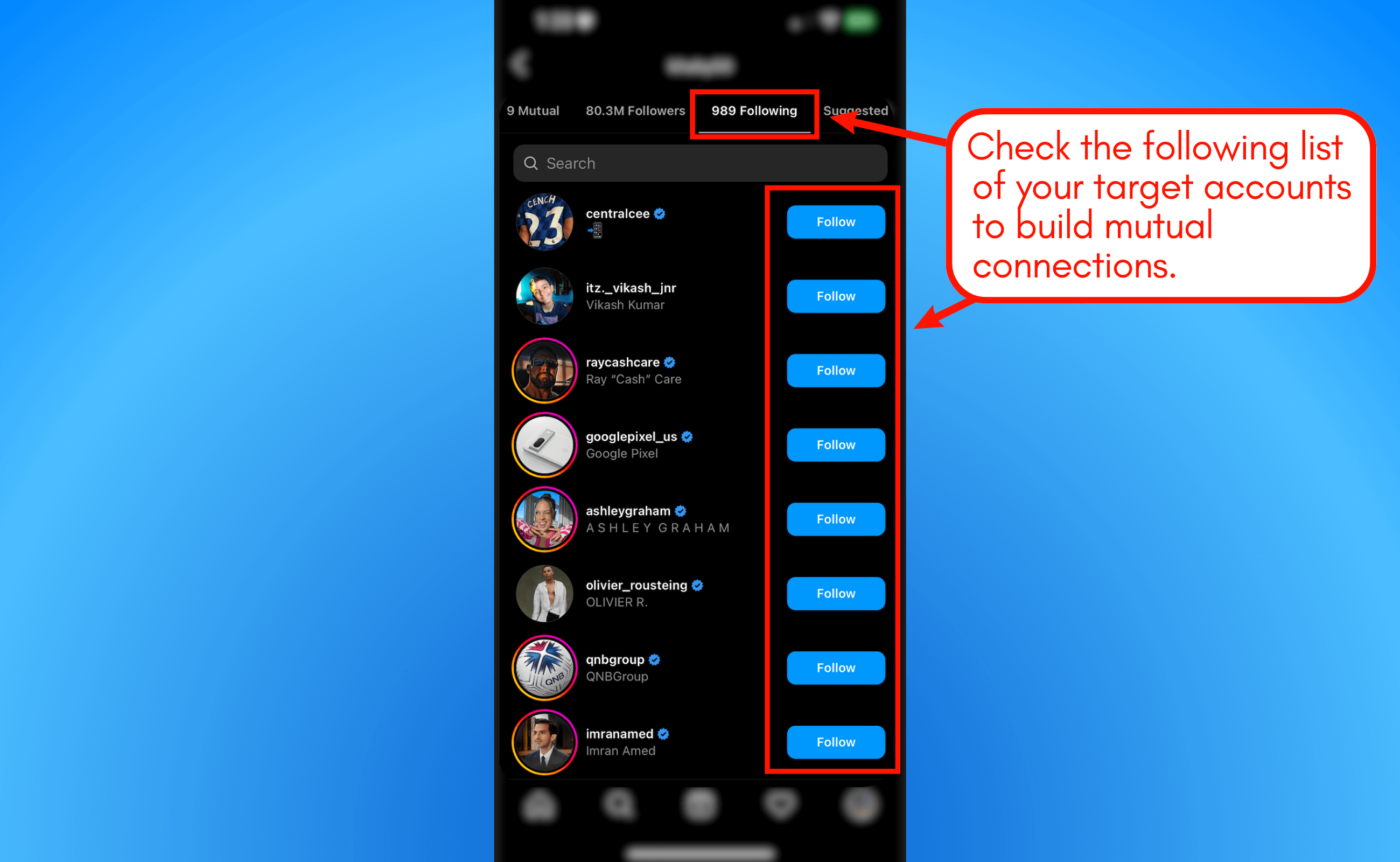

Internships and entry level positions provide valuable exposure to different areas within finance, help professionals identify their preferred specialization. Network with finance professionals and join industry organizations can provide insights into various career options.

Work environment considerations

Finance careers offer diverse work environments, from firm pace trading floors to quiet analytical offices. Some positions require extensive travel and client interaction, while others focus on internal analysis and reporting. Understand these differences help professionals choose roles that match their preferred work style.

Professional development and continuing education

The finance industry requires ongoing professional development to stay current with regulations, market trends, and technological advances. Many employers support continue education through tuition reimbursement and professional development programs.

Industry conferences, workshops, and online courses provide opportunities to learn new skills and network with other professionals. Stay inform about industry developments through financial publications and research reports is essential for career success.

Understand the various pathways within the finance career cluster and identify which careers belong to each pathway help students and professionals make informed decisions about their future. The business finance pathway offer diverse opportunities for those interested in corporate finance, investment analysis, and financial planning, while other pathways focus on banking, insurance, and securities. Success in any finance career require strong analytical skills, continuous learning, and adaptability to change market conditions.

MORE FROM mumsearch.com