Understanding the Utility Cost Difference: Home vs. Apartment

Introduction: Comparing Utility Costs in Homes and Apartments

When weighing your housing options, utility expenses play a significant role in your monthly budget. While rent or mortgage payments are the most obvious costs, utilities like electricity, water, gas, trash, and internet can add up quickly. Understanding the average cost difference between homes and apartments-and the reasons behind it-will help you make informed housing decisions and manage your finances effectively.

Average Utility Costs: Homes vs. Apartments

On average, utility costs for a home are $100-$250 higher per month than for an apartment. For most single-family homes in the U.S., the combined monthly utility bill typically ranges from $310 to $570. In contrast, apartments-especially those in multi-unit buildings-see lower average utility costs, typically between $180 and $330 per month [1] . These figures reflect typical usage for electricity, natural gas, water, sewer, trash, and internet or cable.

For further context, the national average utility bill for a 915-square-foot apartment is about $253 per month, though this number can rise with the addition of internet or cable services [2] . Meanwhile, the median utility cost for U.S. apartments is roughly $150 per month, according to recent survey data, but this often excludes services like internet and varies by region [3] .

Breakdown by Utility Type

- Electricity: Homes: $120-$180/month; Apartments: $60-$100/month

- Natural Gas: Homes: $50-$100/month; Apartments: $30-$60/month

- Water & Sewer: Homes: $60-$100/month; Apartments: $30-$50/month

- Trash/Recycling: Homes: $20-$40/month; Apartments: Often included in rent

- Internet/Cable: Homes: $60-$150/month; Apartments: $60-$120/month

These estimates can fluctuate based on square footage, number of occupants, and geographic location [1] [2] .

Why Are Home Utility Costs Typically Higher?

Several key factors explain why homes usually have higher utility costs than apartments:

1. Size and Square Footage: Homes are generally larger than apartments. More space means more air to heat or cool and more rooms to light, which directly increases energy and water usage. For example, it takes considerably more energy to maintain a comfortable temperature in a 2,000-square-foot home than a 900-square-foot apartment.

2. Exposure and Insulation: Apartments, especially those in multi-unit buildings, share walls with neighbors, which helps insulate against outdoor temperatures. Single-family homes have more exterior walls, windows, and often less energy-efficient insulation, especially if the home is older. This means homes lose or gain heat faster, leading to higher heating and cooling costs [3] .

Source: chicagorentals.com

3. Outdoor Water Use: Homeowners are responsible for additional water use for lawns, gardens, and landscaping, which renters in apartments rarely face. Seasonal irrigation can drive up water bills, particularly in warmer climates or during drought conditions.

4. Included Utilities: Many apartment complexes include certain utilities-like water, trash, or even gas-in the rent. This arrangement is less common for single-family homes, where occupants are typically responsible for all utility services directly.

Real-World Examples and Case Studies

Consider two residents in Michigan: one rents a 900-square-foot apartment, and the other owns a 2,000-square-foot home. The apartment resident’s average monthly utilities total approximately $253, while the homeowner’s utility costs average $411 per month, partly due to increased space and outdoor water usage [5] . In another example, renters in Dallas, TX, may pay $110-$170 per month for apartment utilities, while homeowners in the same city frequently face utility bills exceeding $300 monthly.

How to Estimate Your Utility Costs

Estimating your utilities before moving is crucial for accurate budgeting. To do this:

- Research local averages: Use reputable sources such as your local utility providers’ websites or recent housing surveys to find average costs for your city or state. Some utility companies provide online calculators or sample bills for typical homes and apartments in your area.

- Request historical bills: If possible, ask the current resident or landlord for past utility bills. This is especially useful for homes, where usage can vary widely based on size and energy efficiency.

- Ask what’s included: Always verify with your landlord or leasing agent which utilities are included in rent. In many apartments, water, trash, or even heat may be bundled, lowering your out-of-pocket costs.

- Factor in your usage: Consider your lifestyle. Do you work from home? Own energy-intensive appliances? Have many occupants? Each of these increases utility usage and costs.

Ways to Manage and Reduce Utility Bills

Regardless of whether you live in a home or apartment, there are proven ways to keep utility expenses under control:

1. Upgrade to Energy-Efficient Appliances: Modern appliances use less energy and water. Look for ENERGY STAR-rated devices when replacing old equipment.

2. Improve Insulation and Sealing: For homeowners, adding insulation, sealing windows, and repairing weather stripping can dramatically decrease heating and cooling costs. Renters can use draft stoppers and thermal curtains to minimize temperature loss.

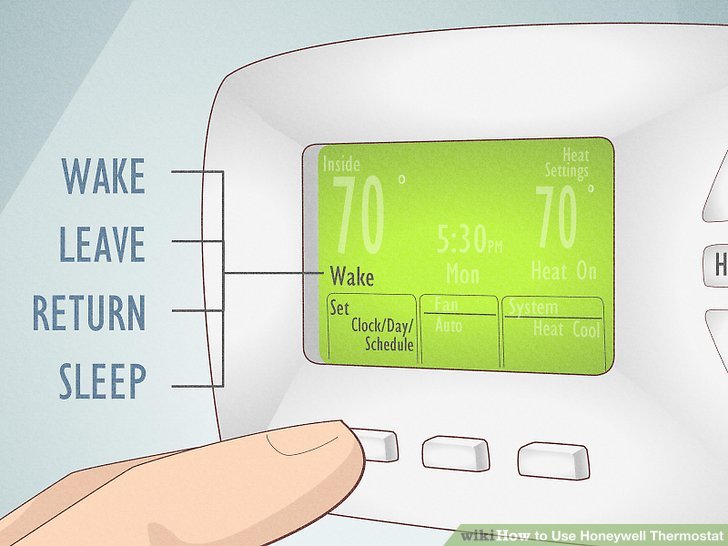

3. Adjust Thermostat Settings: Setting your thermostat just a few degrees higher in summer or lower in winter can lead to substantial savings. Programmable thermostats can automate these adjustments for optimal efficiency.

4. Reduce Water Usage: Install low-flow showerheads and faucets, fix leaks promptly, and limit outdoor watering to the early morning or evening.

5. Take Advantage of Utility Assistance Programs: Many states and utility providers offer programs that help residents lower their bills-especially for low-income households or those facing hardship. To learn more, contact your local utility provider or search for state-run utility assistance or energy efficiency programs. If you’re uncertain about eligibility or where to apply, visit your state’s official energy or public utilities commission website and search for “energy assistance.”

Implementation Steps for Prospective Renters and Homeowners

To effectively budget and plan for utility costs, follow these steps:

- Identify your property type and size: Write down the square footage and number of occupants, as usage scales with both.

- Use online calculators: Many utility providers offer free online calculators to estimate monthly bills based on your location and home size. Search for your city’s main electric or water provider and look for “estimate your bill” tools.

- Contact utility providers directly: For the most accurate estimates, call your local electric, water, and gas companies. Ask for average usage and cost data for similar properties in your area.

- Compare multiple properties: If you’re deciding between a home and an apartment, request utility cost breakdowns for each. Keep in mind that older homes may have higher bills if they lack energy-efficient upgrades.

- Review lease and contract terms: Ensure you understand which utilities you’ll be responsible for and which may be included in your rent or HOA fees.

Challenges and Solutions in Managing Utility Expenses

Challenge: Wide variance in costs due to property age, climate, and lifestyle can make budgeting difficult.

Solution: Always use your own expected usage patterns as the baseline and adjust with a 10-20% buffer to cover seasonal spikes or unforeseen circumstances.

Challenge: Utility providers may bill on different cycles, making tracking expenses tricky.

Solution: Set up calendar reminders for each bill due date and consider using budgeting apps that allow for recurring expense tracking.

Challenge: Unexpectedly high bills due to inefficiencies or leaks.

Solution: Regularly check for leaks, replace air filters, and schedule professional HVAC maintenance annually.

Alternative Approaches and Additional Tips

If utility costs are a major concern, consider the following:

Source: rentcafe.com

- Look for apartments in newer, energy-efficient buildings.

- Opt for homes with modern HVAC systems, double-paned windows, and smart thermostats.

- Explore shared housing or co-living arrangements to split utility costs among several occupants.

- If eligible, apply for local, state, or federal utility assistance programs by searching for “Low Income Home Energy Assistance Program (LIHEAP)” or contacting your state’s energy office.

Key Takeaways

Overall, expect to pay $100-$250 more per month in utilities for a home compared to an apartment, largely due to increased space, exposure, and additional services. However, your actual costs may vary based on property characteristics, local rates, and personal usage. By researching, planning, and employing energy-saving measures, you can effectively manage your utility expenses regardless of where you live.

References

- [1] Kemang House for Rent (2025). How Much More Is the Average Cost of Utilities for a Home When Compared to an Apartment?

- [2] Apartment List (2024). Estimating Apartment Utilities Cost.

- [3] Zillow (2025). How Much Are Utilities in an Apartment?

- [4] Greystar (2024). Average Cost of Electric Bills in Apartments.

- [5] Consumers Credit Union (2023). The Costs of Owning a House vs. Renting.

MORE FROM mumsearch.com