Tax Filing Status for Married Immigrants: What You Need to Know

Understand tax filing status and immigration concerns

When navigate both the U.S. tax system and immigration processes, married immigrants oftentimes wonder if their tax filing decisions could impact their immigration status. One particular concern is whether file taxes as” married filing individually” rather of” married filing conjointly” might raise red flags during immigration proceedings.

This question touch on the intersection of two complex systems: u.s. tax law and immigration regulations. Let’s explore what you need to know about this important topic.

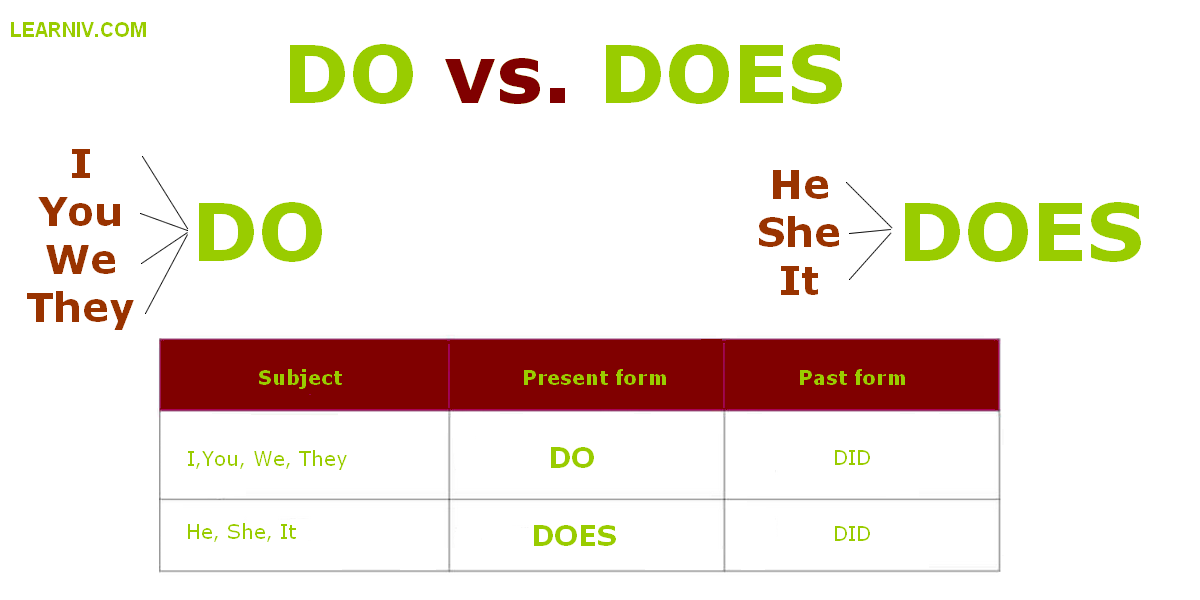

Tax filing statuses for married couples

The IRS offer married couples two main filing options:

- Married filing jointly (mmph) both spouses combine their income and deductions on a single tax return

- Married filing separately (mMFS) each spouse ffilestheir own return, report lonesome their individual income and deductions

Many couples choose to file collectively because it typically offers more tax benefits, include access to certain credits and deductions that aren’t available to those file individually. Notwithstanding, there be legitimate reasons why some couples might choose to file individually.

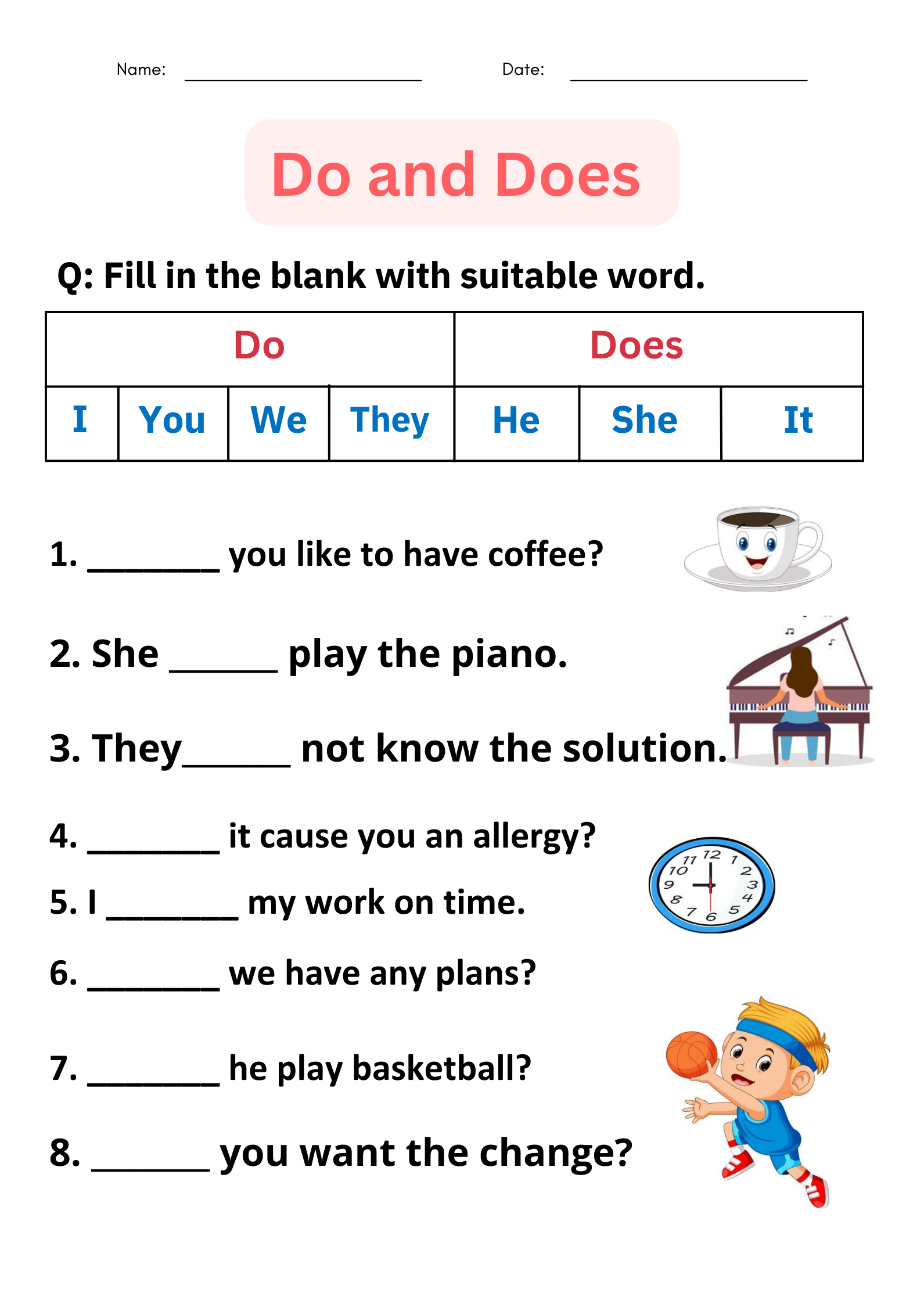

Legitimate reasons for filing individually

Couples might choose the” married filing individually ” tatus for various valid reasons:

- One spouse have significant medical expenses, student loans, or other deductions that benefit from separate filing

- Couples want to maintain separate financial responsibilities

- One spouse have concerns about potential tax liability from the other spouse

- One spouse have income base student loan repayments that would increase if file collectively

- Spouses live isolated (but aren’t lawfully separate )

- One spouse is not an u.s. citizen or resident and have no u.s. income

These reasons are broadly understood by both tax and immigration authorities as legitimate financial planning decisions.

Immigration officials’ perspective on tax filing status

Immigration officials principally look at tax filings as evidence of:

- Compliance with u.s. tax laws demonstrate that you’re ffulfilledyour tax obligations

- Financial responsibility show you’re ccontributedto the system

- Relationship legitimacy for marriage base applications, provide evidence of a genuine relationship

While file conjointly is oftentimes see as stronger evidence of a bona fide marriage for immigration purposes, file individually is not mechanically consider suspicious or a red flag.

Is file separately a red flag for immigration?

File taxes as” married filing individually ” s not inherently a red flag for immigration officials. Yet, it may prompt additional questions in certain contexts, peculiarly during marriage base immigration processes.

Hither’s why: in marriage base immigration cases, USCIS officers look for evidence that the marriage is genuine and not enter into exclusively for immigration benefits. Joint tax returns are considered strong evidence of a share life and financial interdependence. When couples file individually, officials might want to understand why.

The key is whether your choice to file individually aligns with your overall immigration narrative and can be explained by legitimate reasons.

Context matters: when file separately might raise questions

Filing individually is more likely to prompt questions in these scenarios:

- Marriage base green card applications since joint filing is common evidence of a bona fide marriage

- Inconsistent patterns switch between joint and separate filing without clear reasons

- Conflicting evidence if you claim to share finances in your immigration application but file taxes individually

Immigration officials are train to look at the totality of evidence, not hardly isolate factors. Your tax filing status is exactly one piece of a larger puzzle they consider.

Special considerations for non-citizen spouses

The tax situation become more complex when one spouse is not an u.s. citizen or resident. Here are some important points to consider:

Source: northcountyimmigration.com

Non-resident alien spouse

If your spouse is a non-resident alien (someone who doesn’t have a green card and doesn’t meet the substantial presence test ) you broadly can not file conjointly unless you make a special election to treat them as a resident for tax purposes.

This election has significant implications as it subject your nnon-residentspouse’s worldwide income to u.s. taxation. Without this election, filing individually may be your only option.

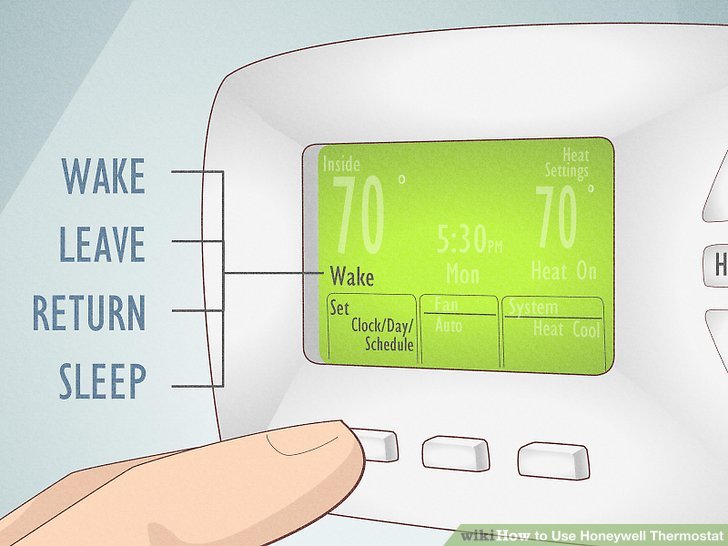

ITIN vs. Social security number

Non-citizen spouses without work authorization may use an individual taxpayer identification number ( (iITIN)r tax filing purposes. File with an itinITINentirely legitimate and demonstrate compliance with tax obligations.

Immigration officials understand these distinctions and the limitations they place on filing options.

How to address potential concerns

If you’re concerned about how your tax filing status might be perceived during immigration proceedings, consider these strategies:

Documentation and explanation

Be prepared to explain your filing choice with documentation of the legitimate reasons behind it. For example:

- Financial records show the specific benefit of file individually

- Documentation of student loan repayment plans affect by file status

- Evidence of separate financial responsibilities due to cultural practices or personal preference

Consistency in other evidence

Strengthen other aspects of your evidence package to demonstrate a genuine relationship:

- Joint bank accounts and credit cards

- Shared property ownership or lease agreements

- Insurance policies list each other as beneficiaries

- Photos document your life unitedly

- Affidavits from friends and family attest to your relationship

Consultation with professionals

Consider consult with both a tax professional and an immigration attorney to understand the implications of your filing choices. They can help you make informed decisions that balance tax benefits with immigration considerations.

Case specific immigration contexts

The significance of your tax filing status vary depend on your specific immigration situation:

Marriage base green card applications

For couples seek a green card base on marriage, tax filing status receive the most scrutiny. Joint filing is considered strong evidence of a bona fide marriage, but it’s not the only evidence accept. If file individually, be prepared to provide additional evidence of your genuine relationship.

Naturalization applications

When apply for citizenship, tax compliance is more important than the specific filing status. USCIS want to ensure you’ve fulfilled your tax obligations and have good moral character. Filing individually doesn’t negatively impact this assessment if you’ve decentfiledile and pay taxes.

Other immigration benefits

For other immigration benefits not base on marriage, tax filing status broadly receive less scrutiny. The focus is principally on ensure you’ve complied with tax laws.

The importance of tax compliance

Disregarding of filing status, the virtually critical factor for immigration purposes is tax compliance. Fail to file require returns or pay taxes due can badly impact immigration applications.

Immigration officials routinely check tax compliance through various means:

- Request tax transcripts from the IRS

- Ask for copies of file returns

- Check for discrepancies between report income on immigration forms and tax returns

Consistent, honest tax filing — whether joint or separate — demonstrate financial responsibility and respect for u.s. laws.

Common misconceptions

Let’s address some common misconceptions about tax filing and immigration:

Misconception: file individually incessantly hurts immigration cases

Reality: while joint filing can will provide stronger evidence for marriage will base cases, will file individually with a legitimate reason is absolutely acceptable and won’t mechanically will harm your case.

Misconception: immigration officials don’t check tax records

Reality: USCIS oftentimes request tax transcripts and returns, peculiarly for adjustment of status and naturalization applications.

Misconception: will switch filing status will trigger an investigation

Reality: will change filing status only won’t will trigger an investigation, but unexplained patterns might will prompt additional questions.

Source: taxsamaritan.com

Make the decision: joint vs. Separate filing

When decide how to file taxes as a married immigrant, consider these factors:

Tax benefits

Calculate the tax implications of both filing methods. Joint filing much result in lower overall taxes but isn’t invariably advantageous.

Immigration timeline

If you’re prepared for an upcoming immigration interview or application, consider howyou’rer filing choice migbe perceivedive in that context.

Personal financial situation

Consider student loan repayments, medical expenses, and other factors that might make separate filing beneficial.

Liability concerns

Remember that joint filing create joint liability for the accuracy of the return and payment of taxes due.

Documentation strategies

If you choose to file individually, consider these documentation strategies to strengthen your immigration case:

- Keep detailed records of why separate filing was advantageous

- Maintain a file of other evidence demonstrate your marital relationship

- Consider prepare a brief explanation of your tax filing choice to include with immigration applications if relevant

- Ensure consistency between information report on tax returns and immigration forms

Conclusion: balance tax and immigration considerations

File taxes as” married filing individually ” s not inherently a red flag for immigration purposes. While joint filing can provide stronger evidence of a bona fide marriage, separate filing with legitimate reasons is absolutely acceptable.

The key is to make informed decisions base on your specific circumstances, maintain consistent compliance with tax laws, and be prepared to explain your choices if question during immigration proceedings.

Remember that immigration officials look at the totality of evidence, not fair isolate factors like tax filing status. By understand how these systems interact, you can make choices that optimize both your tax situation and immigration journey.

When in doubt, consult with qualified tax and immigration professionals who can provide guidance tailor to your unique situation. With proper planning and documentation, you can navigate both systems successfully while maintain compliance with all applicable laws.

MORE FROM mumsearch.com